Download this article in magazine layout

Download this article in magazine layout

- Share this article

- Subscribe to our newsletter

Entrepreneurship in times of crises – how access to finance impacts on business operations

A large body of evidence has emerged showing that the Covid-19 pandemic had a negative impact on most small and medium-sized enterprises (SMEs) in Africa, with women-owned enterprises being the most affected. To understand how and to what extent Covid-19 disturbed their business operations, we interviewed agri-entrepreneurs in Ghana, Nigeria and Zimbabwe. To this end, we above all looked at which role access to financing played in business survival.

General implications and coping strategies

These case studies were part of a larger research exercise across six value chains in six African countries, in the context of which a market survey of 119 actors was conducted in mid-2020. Here, the actors selected were those whose businesses directly source from and/or impact on smallholder producers. This included aggregators, input suppliers, processors, export traders, seed producers and retailers. In addition, some of the sampled agri-SMEs also engage in primary agricultural production. The businesses involved were representative of typical market actors in their countries, based on the number of employees. Data among the 119 actors was collected via telephone, whereas data for the case studies was provided in person.

From the market survey, we observed that the majority of agri-SMEs, regardless of their size, made changes to their business operations as a response to different national Covid-19 restrictions. This was the case for all businesses having between 50 and 100 employees, 86 per cent of those with between 21 and 50 employees, 80 per cent of those without any employees, 67 per cent of those with over 100 employees, 65 per cent of those having between 1 and 10 employees as well as 55 per cent of those with between 11 and 20 employees.

In terms of the specific type of changes made or experienced by the businesses, we found that most surveyed agri-SMEs made changes that affected the marketing of their goods (72 %). In addition, just under 70 per cent of all surveyed agri-SMEs also made changes related to health and safety standards of their business premises. Amongst the sample, a few agri-SMEs stated that they experienced labour supply shortages (40 %), and some had disruptions in their financing (22 %).

Support schemes…

Being aware of the critical role of financing for agri-entrepreneurship and sustained economic activity, many African countries put in place different mechanisms to support micro, small and medium-sized enterprises (MSME)s during the pandemic. Ghana, for example, launched various initiatives, including the Covid-19 Emergency Relief Fund and the Coronavirus Alleviation Program Business Support Scheme (CAP-BuSS). By the end of 2022, a total number of 302,000 successful applicants had been provided with loans under CAP-BuSS, which had an overall committed budget of 750,000,000 Ghanaian shillings (approximately 130 million US dollars in 2020 equivalency), with roughly 70 per cent of beneficiaries being MSMEs owner-managed by women. The fund also concurrently created more than 21,800 jobs, especially for youth. Other funding mechanisms were put in place as well, including soft loans targeting SMEs for recovery.

Measures taken by Nigeria included implementing the Covid-19 Survival Fund and the MSME Survival Fund Scheme. The former is a fiscal stimulus package which included a 138.89 million USD credit facility to households and SMEs most affected by the pandemic. The latter was a financing vehicle for various sectors, including the manufacturing, artisanal and transport sectors and all MSMEs in general. As of August 2021, the Nigerian government had disbursed an equivalent of 138.28 million USD to over one million businesses, 43 per cent of which were owned by women. In Zimbabwe, the government unveiled a 720 million USD (18 billion Zimbabwe dollar) Economic Recovery and Stimulus Package aimed at revitalising the economy and providing relief to individuals, families, small businesses and industries impacted by the economic slowdown caused by the pandemic.

… and their impact

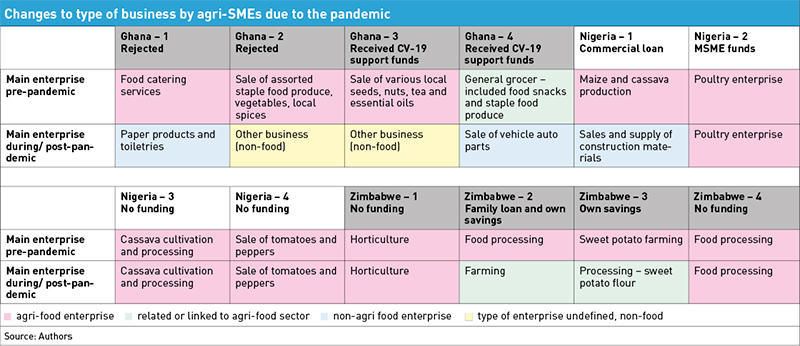

Our case studies in Ghana, Nigeria and Zimbabwe have shown that agri-SMEs which had access to financing (whether commercial funds, family loans or own savings) were more likely to pivot their business away from the agri-food sector during the pandemic. Many enterprises shifted towards non-perishable merchandise and in some cases moved out of agri-entrepreneurship to other sectors (see Table below). In Ghana, all four SMEs interviewed pivoted their agri-food business to non-food, non-agricultural areas. It was also revealed that financing specified for SME Covid-19 survival funds had better repayment terms than commercial loans (having lower interest rates, repayment moratorium and longer repayment periods; see spotlight on Nigeria in Box at the end of article). Despite this, many businesses that we spoke with in the three countries mentioned difficulty with meeting loan requirements – often survival funds were announced in an ad hoc manner and had short response times with some SMEs failing to meet due diligence requirements.

In Ghana, for example, a major challenge was reported to be difficulty with obtaining a tax identification number to meet application conditions and deadlines. In addition, informal businesses that sought to become formally registered in order to access the funds had difficulty to go through the formal business registration process. In Zimbabwe, three of the four SMEs interviewed stated that they had not received any information about any Covid-19-related funds, whether private or public, which were available – although they would have been grateful to receive any amount of cushioning towards their businesses. The other SME had heard of other types of loans which agri-SMEs were able to access during the pandemic, but opted out of applying for them as this required collateral which it could not provide.

Many SMEs that pivoted to other business, especially those that shifted to the non-food or non-agricultural sectors, stated that they had initially done this as a means to survive the pandemic, but that the non-food areas had become their main source of business, as such activities were easier to conduct than the agri-food business. Whether this trend persists now that the pandemic is over is an area for further research.

In order to survive the pandemic, many African agri-SMEs moved to other sectors.

Photo: Dominik Chavez/ World Bank

Implications for policy-makers and financiers

Previous studies have shown that agri-SMEs in Africa were negatively affected by the pandemic mainly as a consequence of insufficient financing with which to pivot their business operations and hedge against negative market dynamics (such as steep decline in demand and low sales volumes, disruption in labour markets) and a cautious lending and investment climate that resulted from the pandemic. Against this background, and as a result of our case studies, we draw five final conclusions for SME incubators, funders and policy-makers:

- Policy-makers and practitioners can promote the sustainability of agri-SMEs by promoting out-of-sector diversification and value addition within the agri-food SME sector. This would enable agri-SMEs to better manage their risk and be more resilient in the face of major market disturbances.

- To tackle the issue of perishability among agri-food enterprises, it is critical for financiers to create specialised support that caters to the particular difficulties these businesses encounter. This should include establishing communal cold chain facilities and/or cold storage services in partnership with local private service providers engaged in facilitating market access and delivering services to the agri-SMEs.

- Financiers should work with relevant government bodies to simplify loan application processes taking into account socio-demographic factors of the agri-SMEs that affect their ability to successfully establish and operate an enterprise, as well as to pivot it in the face of unforeseen market disturbances. This should be coupled with capacity enhancement mechanisms to support SMEs, with for example business literacy and/or facilitating their efforts to formalise their enterprises.

- In general, there is need for widespread access to information about available funding schemes (especially among rural dwellers) and the creation of flexible loan conditions that meet the needs of agri-SMEs. This should include a rethink of types of collateral required and due diligence processes carried out to secure funding.

- Agri-SMEs can benefit from looking at alternative financing options including microfinance, agri-tech crowd-funding and public-private partnerships.

Open research questions

As a consequence of the corona pandemic, limited business operations due to restrictions as well as changes in business operations led to increased operational and transactional costs for agri-SMEs in Africa. This resulted in the majority (89 %) of the smallest surveyed agri-SMEs (mainly those with between 1 and 10 employees) self-reporting business losses. This is similar to findings from other studies which show that SMEs in Africa were negatively affected by the Covid-19 pandemic due to, among many factors, higher operating costs incurred in responding to the pandemic. However, a few surveyed agri-SMEs in this small size category (11 %) self-reported higher profits during the pandemic arising from higher market prices of their goods, panic buying by consumers and fewer enterprises operating in the market. In the absence of proper financial records, it was not possible to quantify the change in profits or to determine if the self-reported profits were sustained beyond the short term. This is an area requiring further research. Neither can the question be answered whether the SMEs who moved to another sector are better off now than the ones who stayed in the agri-food sector. Further research would be required to determine medium to long-term effects of the pandemic but also business decisions that SMEs made.

Spotlight on Nigeria

Case study 1: Accessed commercial loan, after rejection of Covid-19 support funds

A female entrepreneur engaged in maize and cassava production prior to the pandemic applied for the Covid-19 loan and MSME Survival Fund, but was rejected by both schemes. She managed to obtain a loan of 500,000 nira (equivalent to 1,250 USD) from a commercial bank. This loan was a quarter of the capital that she needed/ wanted. The loan was repayable in twelve months with no moratorium at an 18 per cent interest rate. Repayment was expected to start at the end of the month following receipt of the bank loan. Funds from the commercial loan were used to start a non-food enterprise during the pandemic, specifically selling and supplying of construction material.

Case study 2: Accessed MSME Survival Fund

An Ibadan-based entrepreneur engaged in poultry production before the pandemic applied for and received an MSME Survival Fund loan amounting to 200,000 naira (equivalent to 500 USD), which they used to continue their poultry business. Application was made online, and approval was also received online. The loan was repayable in a 36-month repayment plan and had a 6-month moratorium, at a 9 per cent interest rate. Funds were used to buy inputs (such as feed and vet services for poultry business) and repay debts incurred during national lockdown, when sales from their enterprise had dropped significantly.

Case study 3: No access to funding

Two enterprises operating in Ogun and Oyo states of Nigeria engaged in cassava cultivation and processing and sale of tomatoes and peppers, respectively, both applied for and were rejected by the Covid-19 support funds. Neither started a new business, with the cassava enterprise keeping their cassava in the ground, not being able to process it into starch/flour because of low demand due to lockdown measures. The tomato and pepper enterprise continued with business, but at lower revenue levels.

Solomon Duah is a Communication Specialist for the Centre for Agriculture and Biosciences International (CABI) West Africa Centre in Accra, Ghana. He holds a Master’s degree in Communication Studies and is currently pursuing a PhD in Policy and Research Communication.

Adewale M. Ogunmodede is a Senior Lecturer in Agribusiness at the Royal Agricultural University (RAU), UK. He holds an MSc in Agricultural Economics from the University of Ibadan, Nigeria, and is currently completing his PhD in Agribusiness Management at the RAU.

Mariam A.T.J. Kadzamira is a Senior Agribusiness Researcher at CABI and is based in the UK. She holds a PhD in Agricultural Economics from the University of Pretoria, Republic of South Africa.

Contact: M.Kadzamira@cabi.org

Add a comment

Be the First to Comment