Download this article in magazine layout

Download this article in magazine layout

- Share this article

- Subscribe to our newsletter

Digital(ising) rural entrepreneurs in Africa

Sub-Saharan Africa hosts more digital agricultural service providers than any other low- and middle-income region world-wide. By 2022, 666 such services were available in the region. Most offer market linkages or advisory services to farmers, while others facilitate financial transactions or supply chain and enterprise management. Many of these services are run by local entrepreneurs who have put digital technologies at the heart of their business model, for instance by providing dedicated advisory apps, digital payment systems, drone services for monitoring, or insurance schemes that use satellite images to monitor weather conditions.

While more farmers are adopting digital agricultural services on the continent, many services remain small and localised. On average, they serviced around 60,000 users each, reaching just five per cent of sub-Saharan Africa’s farm enterprises in 2022. The geographical focus remains in East Africa. Service providers mainly rely on donor funding, and most do not break even. Nevertheless, a few start-ups have managed to reach scale, in particular those that offer different types of integrated services. The Ghana-founded company Viamo, for instance, uses digital technologies to provide information services, while the Kenyan start-up Pula offers digitally-enabled insurance products. Both companies have expanded to various countries in Africa and even beyond. Such examples remain few, however.

Drone services are also provided to monitor crop health.

Photo: L. Sharma/ Marchmont Communications

Digital tools transforming businesses along the value chain

The low adoption rate of digital agricultural services masks the fact that digital technologies have been transforming the business environment throughout Africa’s food and agriculture sectors. As we move up the value chain, technology use becomes more widespread and sophisticated. Digital tools have become particularly useful to coordinate the complex smallholder-dominated marketing systems that characterise the African food system.

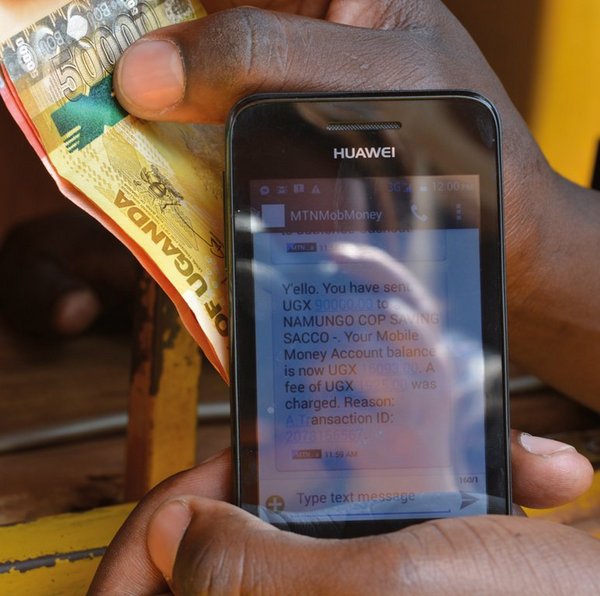

As the first entrepreneurs in the value chain, many farmers are using mobile phones to coordinate their business transactions, albeit to a lesser extent than other actors further along the chain. The use of digital financial services is also on the rise, but less than may be expected. Even in a country like Kenya, where digital payment systems are widely used, most farmers still prefer cash over digital payments in their daily business activities. Rather, mobile money has proven valuable for the transfer of remittances, which can then be invested in the farm, and to deal with shocks. Simple phones tend to dominate, but with the growing availability of affordable smartphones in particular from Asia, a move towards more sophisticated devices is likely only a question of time.

Mobile phone use in business operations is widespread among input and output dealers, much more so than a few years ago. Data from Nigeria, Mali, Kenya and Ghana show that all surveyed dealers use mobile phones in their business activities to exchange information about prices, buyers and sellers and to coordinate purchases and sales. Mobile phones are particularly useful for facilitating frequent communication with larger networks of customers and other dealers. The majority of dealers (although not all) use smartphones. This is even the case in a country like Mali, which commonly scores low in information and communication technology (ICT) indicators. The use of different mobile phone functions in business activities is also becoming more diverse. While phone calls remain the preferred mode of communication, other functions like SMS, messenger services and social networks are increasingly being adopted. Mobile money use is also widespread among dealers. In contrast, only few of them are familiar with digital agricultural services.

One of the most promising applications of digital technologies in the African agriculture sector is to increase the efficiency of the supply chain. Local entrepreneurs are developing sophisticated digital platforms to coordinate the sourcing of produce from a large number of small-scale producers and sales to buyers. Twiga Foods in Kenya is a well-known example. The company buys fresh products, in particular bananas, from smallholder farmers and sells them on to small-scale vendors in Nairobi. Twiga Foods uses an internal management software to coordinate the large number of transactions as well as an app for vendors to order goods from Twiga Foods. The entrepreneurs’ core business is to provide a bridge between producers and buyers, using digital applications to facilitate this business. While such a coordination could also function without digital tools, the transaction costs of scaling operations would be prohibitive.

A women entrepreneur using an app to manage her stock and sales.

Photo: Vincent Tremeau/ World Bank

Moving further up the value chain, we find applications of digital technologies in Africa’s food and beverage manufacturing sector as well. Research in Kenya, Nigeria, Ethiopia and South Africa established that almost half of the surveyed companies in these countries use automation technologies in their operations, most commonly for the processing of sugar and confectionary, meat and dairy products. The companies value the technologies in particular for improving product quality and safety and efficient use of raw materials. While adoption is more common among the larger companies, even small businesses with up to 50 employees are starting to use such technologies. This is particularly the case in Kenya where three quarters of surveyed small businesses were using computer-controlled machinery, but also in Nigeria and South Africa.

Unlocking the full potential of digitalisation in African agriculture

Despite these promising developments, the limits of digital technologies also need to be acknowledged. Farming entrepreneurs are particularly difficult to reach with digital solutions due to lower digital skills and technological capacities. Many farmers and dealers still prefer face-to-face interactions, in particular to negotiate prices or participate in training. In trading, mobile phones are mainly used to strengthen rather than initiate new business relationships. The low adoption rates of digital agricultural services and digital financial services in agricultural business transactions highlight missed opportunities for digital entrepreneurs. Processors struggle to adopt or expand the use of automation technologies due to poorly developed electricity infrastructure, challenges to access and maintaining machinery and skill gaps in the workforce.

To capitalise on the transformative powers of digital technologies, there is a need to promote both digital entrepreneurs and the digitalisation of entrepreneurs in the entire value chain. This will require training to build digital skills from the farm level all the way to the use of advanced automation technologies, financial support to acquire digital technologies and investments in high-quality and affordable connectivity and electricity. More emphasis also needs to be placed on promoting digitalisation higher up in the value chain in such a way that small-scale producers can benefit through better access to information, services and markets.

At the same time, investments in digital capabilities alone will not be able to address many of the existing challenges the African food and agriculture sectors face, but need to be coordinated with other (non-digital) support measures. Such efforts should build on existing structures, which digital tools ought to seek to facilitate rather than replace. Digital agricultural platforms, for instance, are often promoted as a way to cut out the “middlemen”. However, intermediaries often fulfil important functions in the value chain, such as linking producers to information, markets and finance.

Digital service providers can capitalise on intermediaries’ digital skills, technological capacities and digitally enabled networks to improve service delivery and cover the last mile to producers. Thereby, intermediaries could help to overcome challenges often faced by digital service providers related to trust, preferences for face-to-face contact and low digital access among producers. In the case of Twiga Foods, for instance, agents play a crucial role in establishing and maintaining relationships between farmers, vendors and the company. At the same time, digital tools can be used to provide safeguards to minimise fraud and unfair business practices in agricultural markets, for example by increasing the transparency of pricing, offering alternative sources of credit or providing rating systems for quality control.

Heike Baumüller holds a PhD in Agricultural Sciences from the University of Bonn/Germany and is a Senior Researcher at the University of Bonn’s Center for Development Research (ZEF).

Contact: hbaumueller@uni-bonn.de

References:

Baumüller, H., Ikpi, U., Jumpah, E. T., Kamau, G., Kergna, A. O., Mose, L., Nientao, A., Omari, R., Phillip, D., & Salasya, B. (2023). Building digital bridges in African value chains: Exploring linkages between ICT use and social capital in agricultural marketing. Journal of Rural Studies, 100, 103002. https://doi.org/10.1016/j.jrurstud.2023.03.010

Baumüller, H. (2018). The Little We Know: An Exploratory Literature Review on the Utility of Mobile Phone‐Enabled Services for Smallholder Farmers. Journal of International Development, 30(1), 134–154. https://doi.org/10.1002/jid.3314

Beanstalk AgTech. (2023). State of the Digital Agriculture Sector in LMICs. Beanstalk AgTech. https://www.beanstalkagtech.com/d4aglmic

Parlasca, M. C., Johnen, C., & Qaim, M. (2022). Use of mobile financial services among farmers in Africa: Insights from Kenya. Global Food Security, 32, 100590. https://doi.org/10.1016/j.gfs.2021.100590

Add a comment

Be the First to Comment